The Freelancing Diaries: ACC guide for creative freelancers

This year we’ve teamed up with Hnry to bring you ‘The Freelancing Diaries’, a series helping freelancing creatives navigate self-employed life and find their version of financial success.

This quarterly content series is chocka with freelancing business tips to help you navigate running a creative business, as well as de-mystifying some of the barriers for those considering taking the leap.

With annual ACC levies right around the corner, this month we’re focusing on the top tips self-employed creatives need to know when it comes to ACC and their business.

Last week we held a free webinar which ran through the ACC top tips you need to know as a creative freelancer in Aotearoa New Zealand.

If you missed out on registering for the event, here’s a few of the key takeaways we covered and why they’re important if you’re currently running your own creative business or planning to soon.

The tl;dr

- All individuals employed or engaged in business activities within New Zealand are obligated to pay ACC levies each year.

- As sole traders, creative freelancers are required to pay all 3 types of ACC levies and must manage this themselves, whereas employed individuals are responsible for 1 ACC levy which is automatically pulled from their paycheck.

- Sole traders can expect to receive an annual ACC invoice sometime between September and October.

- Your ACC levies are based on a minimum and maximum liable income threshold for Full Time freelancers. If you are working less than 30 hours per week as a freelancer, make sure you are registered as a Part Time worker in ACC – this way you don’t get overcharged if you are making under the minimum liable income level.

- The Earner’s Levy and Working Safer Levy are calculated based on your ‘liable income’ aka the info you declare when you file your taxes.

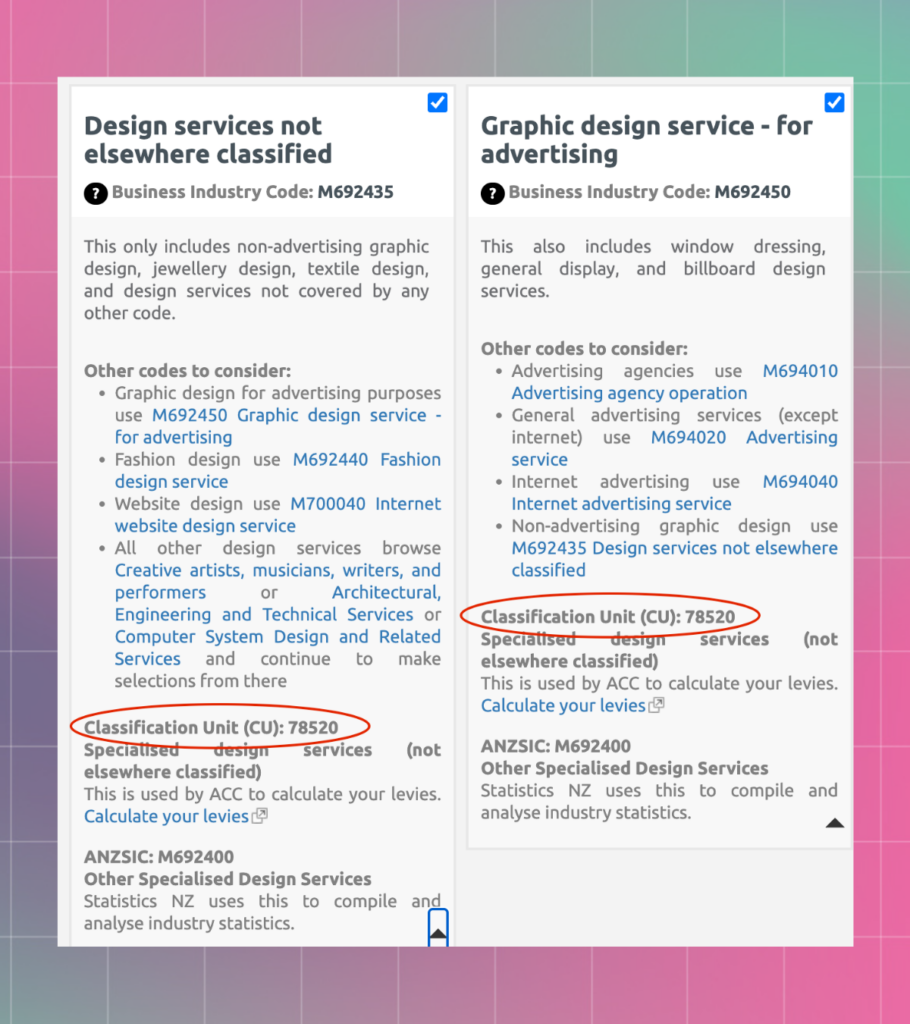

- As a creative business, if you do not specify your job type or ‘CU’ and ACC can not figure it out from your tax filing then they will automatically register you with the job type that incurs the highest ACC fees for the Work Levy. So, make sure to find and register yourself under the correct CU to avoid paying above what you need for this levy.

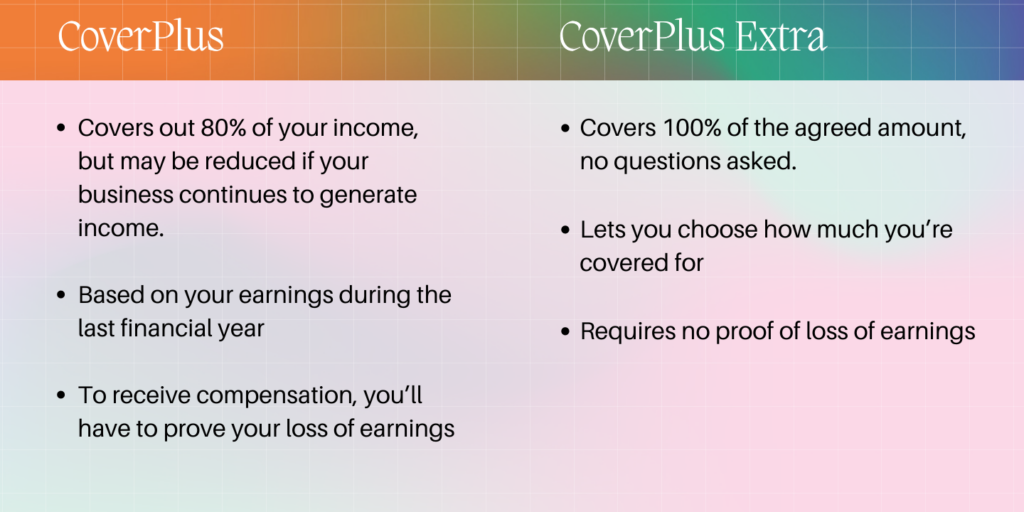

- When you pay your ACC levies, you’re protected under the base plan called ‘CoverPlus’ which covers up to 80% of your income if you have an accident and can’t work. If you need more of your income covered, you can opt to be on the plan ‘CoverPlus Extra’ or CPX. ( this may be a beneficial plan for those who are newly self-employed and not able to prove their past year’s earnings. )

First off, what is ACC and how does it pertain to my creative business?

ACC is short for Accident Compensation Corporation. It is a government organisation that acts like public health insurance.

So if you have an accident in Aotearoa, ACC will help cover things like:

- Your medical and/or physio bills

- Counselling and support for sensitive claims

- Loss of income (up to a certain percentage) if you are unable to work due to an injury

What is an ACC Levy?

To help fund this program, all individuals employed or engaged in business activities within New Zealand are obligated to pay ACC levies each year.

There are three types of ACC levies: Earners’ levy, Working Safer levy, and the Work levy.

Employed folks only have to deal with one levy – the Earners’ levy – which is automatically taken out from their paycheck. Businesses are responsible for the Working Safer levy and the Work levy.

Since sole traders are both the earners and the businesses, they are responsible for paying all three levies.

So, if you are a creative freelancer, then you are not only responsible for paying all three ACC levies but you’ll also need to manage your ACC setup and levy calculations yourself.

This means ensuring you’ve set yourself up under the correct job type and calculated your Earner’s levy, Working Safer levy, and Work levy so you know how much money to set aside.

Each year freelancers or self-employed individuals can expect to receive their annual ACC invoice around September/October.

How to calculate my ACC levies as a freelance creative:

First off, the levies you pay are all calculated off your liable income, which is based on the information you declare when you do your taxes.

🔥Hot tip: ACC sets a minimum and maximum threshold for liable income every financial year, and you’re only required to pay levies on your taxable earnings between these thresholds. You can read more about these thresholds on the ACC website.

Each levy is calculated slightly differently (with rates updated every April):

- The Earner’s levy is a flat rate of $1.33 per $100 (excluding GST) of your liable income. This helps fund cover for injuries that happen during everyday, non-work activities. It’s worth noting: the amount of income assessed by the Earners’ levy is capped, which means for that levy the most you’ll pay is roughly $2,000. To calculate: Liable income / 100 x 1.33 = Your Earner’s Levy

- The Working Safer levy is a flat rate of $0.08 per $100 of your liable income. This helps fund Worksafe NZ, New Zealand’s primary workplace health and safety regulator. To calculate: Liable income / 100 x .08 = Your Working Safer Levy

- The Work levy is based on the industry you operate in and this funds cover for injuries that happen at work. The riskier your line of work, the higher this levy will be. To calculate: we’ll find our CU code, then use the code to find our basic levy rate, and from there use the formula below.

- First find your classification unit ( CU ) using this link. When we typed in ‘graphic design’ into the search bar, here’s what came up:

- Then open the ACC’s levy guidebook and search for your CU code ( use command + f to search quickly ). Your basic levy rate will be listed under the ‘EMP or SEP’ column ( See example below ).

- Finally, use this formula to calculate the Work Levy: Liable Income / 100 x Your Levy Rate = Your Work Levy. So, if we used the above example it would look like: Your liable income / 100 x .11 = Your Work Levy

And, that’s how you calculate your 3 different ACC levies in a nutshell.

🔥Hot tip: Did you know that when you use Hnry they actually do all this work for you without you even having to ask? Yay for outsourcing annoying admin work! Get a $25 credit with this code.

What is CoverPlus and CoverPlus Extra?

When you pay your ACC levies, you’ll be covered for accidents or injuries under a plan called CoverPlus. If you’re unable to work, CoverPlus will pay you up to 80% of your income, calculated based on your reported income from the most recent financial year.

But depending on your needs, lifestyle, and expenses, you might want even more cover.

If this is the case, you can opt to be on a plan called CoverPlus Extra (CPX).

With CPX, you can choose how much you want to receive weekly in the event of an injury or accident (subject to an assessment to determine an appropriate level of cover).

This comes in handy if:

- Your income fluctuates from week to week

- You want to be covered for more than you’ve earned in the previous financial year

- You want to be covered for less than you earn, and reduce your levy rate

- You’re newly self-employed with no earnings history

There are significant advantages to upgrading to CoverPlus Extra, especially if you’re newly self-employed with no earnings history, or if your business would have a hard time proving a loss of income.

If you’re still not sure, you can see a full comparison of the two levels of cover on ACC website.

What do I do if I’ve already received my ACC invoice but the CU is wrong?

If you don’t use Hnry, you can get in touch with ACC directly either via email, their online chat service, or over the phone and ask them to update it. If you use Hnry, let the Hnry team know and they’ll sort it out for you.

What if I’m working part time ( less than 30 hours per week ) and am earning less than the minimum liable income level for ACC?

If you are working under 30 hours per week and are earning less than the current minimum liable income level ( ~$42,000), make sure that you are registered as working part time within ACC.

This way they will base your invoice solely on the amount that you earned rather than at the $42,000 threshold ( which is what full time workers would be charged if they earned at or under that amount for the year ).

Ok, thanks for the info but I can’t be bothered with all this. Can someone else do my ACC admin for me?

Yes, Hnry! They automatically calculate, deduct and pay all of your taxes (and ACC levies) on every payment you receive, so you aren’t caught out with a massive tax bill come tax time. They’ll even file your annual tax return (and GST returns!) all as part of the service.

So, for 1% of your sole trader income (capped at $1500+GST), you can outsource your tax admin saving you time, money, and brain power to focus on your creative jobs. Get a $25 Hnry credit with this code.

Up next week:

In the last article of this month’s series we’ll hear from freelance UI Designer, Jeff Lau, who will be sharing his self-employed journey from what kept him from starting to where he’s at now.

DISCLAIMER: The information on our website is for general educational purposes only. It doesn’t cover all situations and circumstances, and shouldn’t be taken as direct tax advice. If you’re looking for specific help with your taxes, join Hnry and their team of experts can provide you with assistance tailored to your business needs.